Finance apps are a subset of mobile apps designed to help individuals and businesses streamline their financial tasks. From managing daily budgets to tracking investments, these apps serve as personal finance tools that simplify complex monetary tasks.

Finance apps have become inevitable because they enable you to track and manage your expenses effortlessly, offering convenience, efficiency, and security in financial management.

In 2023, Capital One led the personal finance apps market with an aided brand awareness of 59.73%, according to a report by Statista. TurboTax dominated the tax preparation market with a 53.17% share, followed closely by Credit Karma at 48.42%. This reflects the growing reliance on digital platforms for financial management and tax preparation.

Finance apps range from personal, budgeting, and investment apps to savings apps. Personal finance apps focus on budgeting and tracking expenses, while mobile banking features provide efficient banking access.

Investment tracking apps help users monitor portfolios, while other categories include savings, debt management, and cryptocurrency apps. Each type targets specific financial goals, ensuring users find tailored solutions.

Core features of finance apps include budgeting tools, secure payment systems, and real-time account syncing. They analyse spending patterns, offer payment reminders, and even track credit scores. Mobile banking features like fund transfers and account management improve user convenience, while investment tracking apps allow users to monitor portfolios and plan future investments.

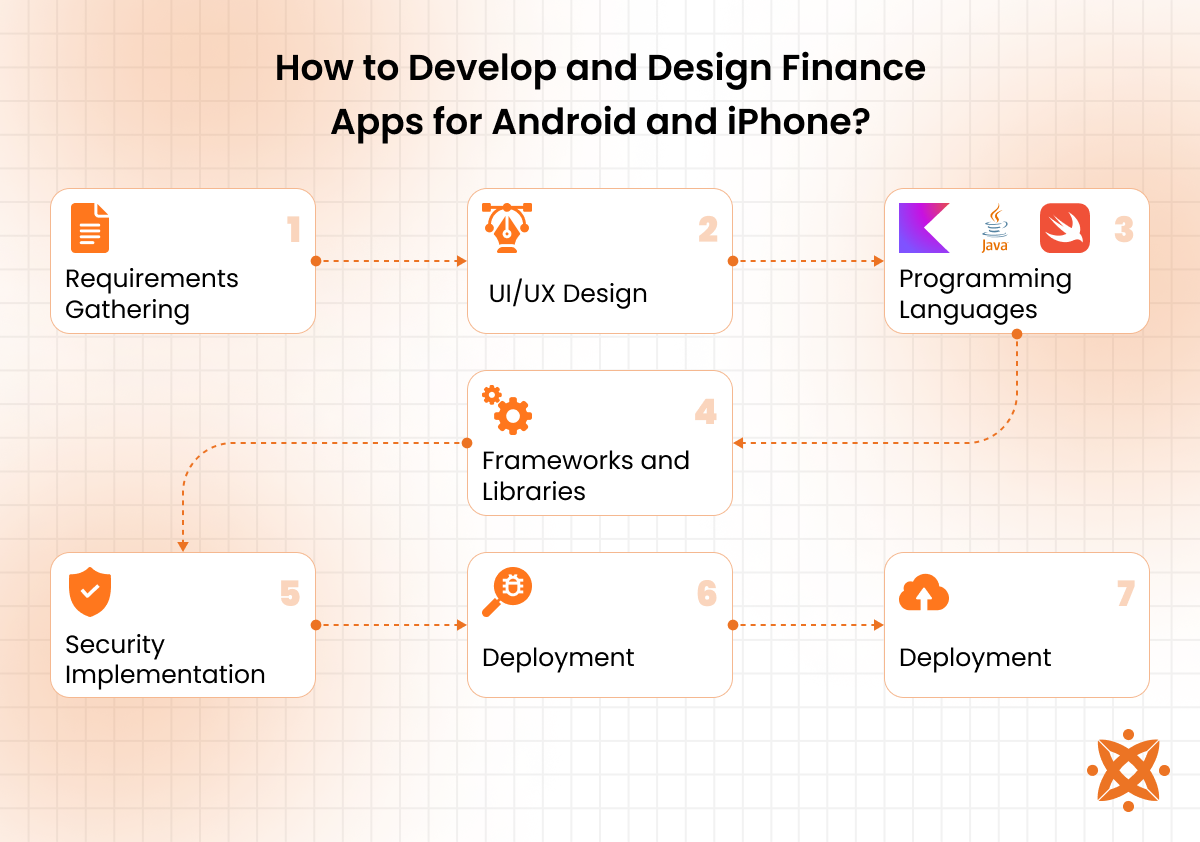

Developing a finance app involves a structured process, from gathering requirements to deployment. Key steps include designing intuitive user interfaces, selecting robust programming languages, and integrating security measures to protect sensitive data. The development process ensures that finance apps are not only functional but also user-friendly and compliant with financial regulations. These apps exemplify the future of financial management through mobile apps.

What is a Finance App?

A finance app is a software application designed to help individuals and businesses manage their financial activities efficiently. These apps provide tools for budgeting, expense tracking, bill payment, investment management, and financial goal setting. Available on smartphones, tablets, and desktops, finance apps simplify complex financial processes, making them accessible to users with varying levels of economic knowledge.

The primary purpose of finance apps is to facilitate financial management by offering a centralised platform to track, plan, and optimise finances. They help users maintain a clear overview of their income, expenses, and savings while providing actionable insights into spending habits. The benefits of using finance apps include better financial literacy, timely reminders for bill payments, and enhanced savings strategies. These apps simplify business accounting, tax management, and cash flow tracking, fostering better financial health and decision-making.

Finance apps automatically gather financial data by linking with a user's bank accounts, credit cards, and investment portfolios. These apps use advanced algorithms and machine learning to categorise transactions, generate reports, and offer personalised advice. Some apps provide features like budgeting templates, goal tracking, and real-time alerts for overspending, while others focus on investment opportunities or debt repayment strategies. Security is a key component, with most apps employing encryption and multi-factor authentication to safeguard user data.

The concept of finance apps emerged in the late 1990s with the advent of personal finance software like Quicken. As smartphones became mainstream in the 2000s, mobile finance apps gained popularity. Apps like Mint and Venmo revolutionised the industry by offering user-friendly interfaces and innovative features like automated budget tracking and peer-to-peer payments. The integration of Artificial Intelligence (AI) and blockchain technology in recent years has further advanced the capabilities of finance apps, making them indispensable tools in modern financial management.

The finance app market has grown exponentially. It was valued at approximately $1.5 billion in 2022 and is projected to reach $3.5 billion by 2030, growing at a CAGR of 12.5%. Popular finance apps like PayPal, Cash App, and Robinhood collectively have over 500 million active users worldwide. According to a report by Market Research Future, nearly 65% of smartphone users in the UK have at least one finance app installed, emphasising their widespread adoption.

Finance apps are widely used across demographics, with millennials and Gen Z leading adoption rates at 80% and 75%, respectively. According to a Fintech Times, over 70% of users use these apps for budgeting and expense tracking, while 40% use them for investment management. Small businesses have also embraced finance apps, with 55% using them for payroll and invoicing. The average user engages with their finance app 8-10 times monthly, reflecting their integral role in daily financial management.

What are the Types of Finance Apps?

The types of finance apps are personal finance apps, budgeting apps, investment apps, savings apps, banking apps, debt management apps, tax management apps, cryptocurrency apps, and money transfer apps. These apps serve different purposes, helping individuals manage their finances in various ways. From managing day-to-day expenses to long-term investment strategies, they provide tools that simplify financial tasks, improve budgeting, and help users stay on track with their financial goals.

The types of finance apps are as follows:

- Personal Finance Apps

- Budgeting Apps

- Investment Apps

- Savings Apps

- Banking Apps

- Debt Management Apps

- Tax Management Apps

- Cryptocurrency Apps

- Money Transfer Apps

1. Personal Finance Apps

Personal finance apps are designed to help individuals manage their entire financial lives in one platform. They track income, expenses, investments, and savings and offer an overview of one's economic health. These apps help users set financial goals, monitor spending patterns, and analyse their financial habits. Some examples of personal finance apps include Mint, YNAB (You Need A Budget), and PocketGuard.

The personal finance app simplifies financial management by consolidating all financial activities into a single interface. With features like automatic transaction categorisation, budget creation, and goal tracking, these apps help users stay on top of their financial game. They also provide insights into spending patterns and suggest improvements to help users achieve economic stability and success.

According to a report by Statista, in 2023, Capital One led the personal finance apps market in the UK, achieving an aided brand awareness of 59.73% among consumers.

2. Budgeting Apps

Budgeting apps focus on helping users create and stick to a budget. They allow users to set monthly or yearly food, entertainment, and transportation budgets. Budgeting apps also ensure that users remain within their financial limits by tracking expenses. Some popular budgeting apps include EveryDollar, GoodBudget, and PocketGuard. According to Fact Mr, the personal finance mobile app market is expanding from an estimated $2.9 billion in 2024 to a colossal $12.58 billion by 2034, fueled by a CAGR of 15.8%.

The basic function of a budgeting app is to provide users with a clear and organised view of their financial inflow and outflow. These apps help individuals and small businesses allocate a certain amount of money to different categories and notify them when they approach or exceed their budgeted amounts. Budgeting apps also offer features like automatic expense tracking, bill reminders, and financial goal-setting to make budgeting effortless.

3. Investment Apps

Investment apps are digital platforms that allow individuals to invest in stocks, bonds, mutual funds, and other securities without the need for a traditional broker. These apps cater to beginner and experienced investors, offering basic tools and advanced features to help users make informed investment decisions. Robinhood, E*TRADE, and Acorns are among the top investment apps today.

Investment apps provide access to various investment options and allow users to build diversified portfolios. They offer many features, including real-time stock tracking, investment advice, automated investing, and portfolio rebalancing. Some investment apps also provide educational resources to help users understand the basics of investing, making them ideal for newcomers to the market.

Investment apps aim to democratise investing by making it more accessible and affordable for everyone. According to a report by Scoop Market, the Investment Apps Market is expected to reach $254.9 billion by 2033, projected at a CAGR of 19.1% during the forecast period.

4. Savings Apps

Savings apps are financial apps designed to help users save money automatically or manually. They allow individuals to set aside small amounts for specific goals, such as vacations, emergencies, or large purchases. Saving apps like Digit, Qapital, and Simple use algorithms or rounding features to help users save without feeling the impact. According to Think with Google, 73% of smartphone users have used a saving app to manage their finances in 2023 monthly.

The primary purpose of a savings app is to encourage users to save money effortlessly by automating the process. These apps analyse spending patterns and automatically transfer small sums of money into savings based on preset criteria, such as rounding up purchases or setting up recurring transfers. Some savings apps also offer high-yield savings accounts or give users cashback rewards to incentivise saving.

5. Banking Apps

Banking apps provide digital access to a user's bank account, allowing them to manage their finances on the go. These apps allow users to check balances, transfer money, pay bills, and view transaction history. Today, almost every bank has a banking app that enables account holders to manage their accounts remotely.

Traditional banks like Chase, Wells Fargo, and Bank of America and digital-only banks like Chime and Revolut have banking apps. According to a report by Statista, 43.5% of households in the UK use mobile banking. The age group with the highest mobile banking penetration is 15-24, indicating a strong preference for digital banking solutions among younger consumers.

The purpose of a banking app is to offer users easy and convenient access to their bank accounts and services. These apps allow for features such as bill payments, mobile check deposits, account transfers, and money management tools. Modern banking apps also feature robust security measures like two-factor authentication to protect users' financial information and provide peace of mind.

6. Debt Management Apps

Debt management apps are designed to help users manage and pay down their debt. Apps like Debt Payoff Planner, Tally, and Mint allow users to track credit card balances, loans, and other debts and create repayment plans that suit their budgets. According to Money Management International, Undebit has helped eliminate over 700,000 debts. More than 120,000 active users are working to pay down $8.7 billion in debt, showcasing its effectiveness in tackling financial burdens.

Debt management apps aim to help users organise and prioritise their debts, making paying them off more efficient and easier. These apps feature tools that calculate minimum payments, suggest debt repayment strategies (such as the snowball or avalanche method), and offer reminders to ensure users stay on track. Debt management apps aim to alleviate the stress of managing multiple debts by providing a clear path to debt freedom.

7. Tax Management Apps

Tax management apps are designed to help individuals and small businesses track and manage their taxes, making the filing process easier. These apps allow users to organise their financial documents, track expenses, and calculate potential tax deductions.

TurboTax, H&R Block, and TaxSlayer are tax management apps that simplify the tax preparation and filing process. They offer tools that automate calculations and ensure users don't rely on deductions or credits. These apps guide users through the process with step-by-step instructions, supporting self-employed individuals, freelancers, and small businesses. Tax management apps also allow for easy e-filing and direct deposit of refunds.

According to a 2023 report by Statista, TurboTax dominated the tax preparation market with a 53.17% share. Credit Karma also held a significant portion, accounting for 48.42% of the market.

8. Cryptocurrency Apps

Cryptocurrency apps provide users with a digital platform to buy, sell, and manage their investments in digital currencies such as Bitcoin, Ethereum, and Litecoin. These apps also allow users to track prices, trade digital currencies, and store them in secure wallets.

Binance and Bybit are two prominent cryptocurrency apps. Binance boasts over $23 billion in trading volume, supporting 454 coins and fiat currencies like EUR, GBP, and BRL. On the other hand, Bybit has a trading volume of $8.19 billion, featuring 720 coins and supporting fiat currencies such as USD, EUR, and GBP.

Cryptocurrency apps' main purpose is to provide users with a secure and efficient way to manage their cryptocurrency portfolios. These apps offer features such as real-time price tracking, access to various cryptocurrencies, and secure wallet storage options. Some apps also provide educational content to help users understand the complexities of the cryptocurrency market, making them ideal for both beginners and seasoned investors.

9. Money Transfer Apps

Money transfer apps allow users to send and receive money quickly and securely across different platforms with minimal fees. These apps commonly send money to family and friends or pay for goods and services. PayPal, Venmo, and Zelle are among the most popular money transfer apps globally.

According to Verified Market Research, the money transfer app market size was valued at $20.15 billion in 2023 and is projected to reach $65.38 billion by 2031, growing at a CAGR of 18.3% during the forecast period 2024-2031.

Money transfer apps simplify money transactions across geographical boundaries without the need for traditional banking systems. These apps offer features like instant money transfers, direct deposits, bill payments, and splitting payments among groups. Money transfer apps link to users' bank accounts or credit cards and provide real-time updates to ensure transactions are completed smoothly and securely.

What Are the Features of a Finance App?

The features of a finance app are secure transactions, budgeting and trackingexpenses, spending habits analysis, and account syncing. These features are designed to simplify the management of personal finances and ensure security, organisation, and ease of use.

The features of a finance app are as follows:

- Secure Transactions: Secure transactions are an important feature of finance apps that ensures all financial exchanges, such as bill payments or transfers, are conducted safely. These apps use encryption protocols, two-factor authentication (2FA), and fraud detection systems to protect users' sensitive information. The app's security features safeguard user data from unauthorised access, maintaining high trust. Secure transactions are important for preventing financial fraud and giving users peace of mind when managing their finances digitally.

- Spending Habits: Spending habits refer to the tracking and analysis of a user's expenditure patterns. Finance apps track purchases across different categories and provide detailed insights into where money is being spent. By monitoring spending habits, these apps help users identify areas where they are overspending, encouraging more mindful spending decisions. Finance apps categorise expenses and set alerts to notify users when they are close to exceeding their budget in any category.

- Credit Score Monitoring: Credit score monitoring is a feature that helps users monitor their credit scores by providing regular updates and alerts. Finance apps offer users a free, real-time view of their credit scores and an analysis of factors affecting them. Monitoring the credit score regularly allows individuals to take proactive steps to improve or maintain it, which is important for loan approvals and financial health. This feature includes tips on improving credit scores and alerts about significant changes, helping users avoid surprises.

- Payment Reminders: Payment reminders are features within finance apps that help users stay on top of their bills and subscriptions. These reminders notify users about upcoming due dates for credit card bills, loans, and utility payments, helping them avoid late fees or penalties. By setting reminders, users ensure their accounts remain in good standing and prevent service disruptions. Finance apps also allow users to set recurring payments for bills, guaranteeing timely settlement of obligations.

- Budgeting and Tracking Expenses: Budgeting and tracking expenses are core functions of most finance apps. These apps allow users to allocate funds to different categories and monitor spending. They also let users create budgets for groceries, entertainment, and transportation. These apps automatically track expenses and alert users when nearing or exceeding their budget limits, encouraging better money management. Through detailed reports, users gain insights into where their money is going, helping them make necessary adjustments to stay within their financial goals.

- Account Syncing: Account syncing allows finance apps to integrate and synchronise data across multiple bank accounts, credit cards, and financial platforms. This feature lets users view all their financial data in one place, regardless of where their accounts are held. The app provides real-time balances, transactions, and financial activity updates across various platforms by syncing accounts. Account syncing improves the app's functionality by offering a consolidated overview of users' economic status, making managing and tracking finances easier.

- Analyse Spending Patterns: Analyzing spending patterns helps users understand how their money is spent over time. Finance apps use algorithms to categorise and analyse every transaction, offering insights into recurring expenses, trends, and spending habits. By identifying these patterns, users make more informed decisions about where to cut back and adjust their budget. This feature also helps users identify potential savings opportunities and optimise their financial strategies for long-term success.

How to Develop and Design Finance Apps for Android and iPhone?

To develop and design finance apps for Android and iPhone, you need to follow a structured approach that includes planning, designing, coding, and testing. The process involves selecting the right tools, frameworks, and technologies to ensure both functionality and security for financial transactions.

To develop and design finance apps for Android and iPhone, you need to do the following things:

Android Finance App Design and Development Process

The Android finance app development process involves using Android-specific tools and technologies to build a secure, user-friendly, and functional application for managing finances. It requires a good knowledge of Android SDK, security protocols, and UI/UX design principles.

The Android finance app design and development process is as follows:

- Requirement Gathering: The design and development process for a finance app begins with identifying the app's purpose, target audience, and core functionalities, such as budgeting tools, secure transactions, and account syncing. During this phase, user needs must be addressed while ensuring compliance with financial regulations like GDPR and data encryption laws.

- UI/UX Design: The next step is creating a user-friendly design once the requirements are clear. Designers craft wireframes and prototypes using tools like Figma or Adobe XD, adhering to Android's Material Design guidelines. This ensures the app is intuitive, visually appealing, and easy to navigate for budgeting and transaction tracking tasks.

- Choosing Programming Languages: After finalising the design, development begins using Kotlin or Java, the primary programming language for Android. Kotlin is preferred for its efficiency and fewer errors. Android Studio serves as the development environment to streamline coding and debugging.

- Frameworks and Libraries: With the development underway, frameworks like the Android SDK are integrated for core functionalities. Firebase handles real-time databases and user authentication, while libraries like Retrofit enable API calls for features like payment gateways.

- Security Implementation: As financial data is sensitive, robust security measures are implemented. This includes encryption (AES, SSL) and authentication (2FA, biometrics). Developers also ensure compliance with privacy laws to protect user data.

- Testing: The app undergoes rigorous functionality, security, and performance testing. Tools like the Android Emulator and Firebase Test Lab simulate various scenarios, while beta testing gathers user feedback to refine the app.

- Deployment: After testing, the app is prepared for launch on the Google Play Store. Developers create promotional materials, ensure policy compliance, and submit the app for review. Once live, the app is monitored for performance, and updates are rolled out as needed.

iPhone Finance App Design and Development Process

The iPhone finance app development process involves using Apple's development ecosystem, including Xcode, Swift, and iOS-specific frameworks. The focus is security, seamless integration with Apple services, and a premium user experience.

The iPhone finance app design and development process is as follows:

- Requirement Gathering: The process of designing and developing a finance app starts by identifying fundamental features like budgeting tools, secure payments, and account syncing while considering the target audience's needs. High-performance and smooth interfaces are required for iOS apps, so Apple's user experience guidelines must shape the design from the beginning.

- UI/UX Design: Following Apple's Human Interface Guidelines, the designers create an intuitive and visually appealing interface using tools like Figma or Sketch. In this step, they include features such as dark mode and animations to enhance usability and clearly display financial data.

- Choosing Programming Languages: The development of the finance app primarily uses Swift due to its efficiency and integration with Apple's frameworks. Xcode, Apple's official IDE, provides coding, debugging, and testing tools, ensuring a streamlined development process for high-performance apps.

- Frameworks and Libraries: The next step is to utilise Apple's native frameworks, such as Core Data for local databases and Core Animation for smooth transitions. Integrate payment systems like Apple Pay or third-party services like Stripe for secure and efficient payment processing.

- Security Features: Enhancing security with Apple's Keychain is the next important step in finance app development. At this stage, a credible security feature is added for storing sensitive data and encryption protocols like AES and SSL. Biometric authentication methods, including Face ID and Touch ID, provide secure and convenient login options while ensuring compliance with privacy regulations like GDPR.

- Testing: During the finance app development testing stage, Xcode's simulators and XCTest are used to test the app across devices and configurations. Conduct security tests to eliminate vulnerabilities and ensure compliance with Apple's standards. Beta testing via TestFlight gathers real-user feedback to refine the app.

- Deployment: Metadata, such as screenshots and app descriptions, for a fully tested finance app, is prepared and submitted through App Store Connect. Apple reviews the app for compliance before approving its release on the App Store. Post-launch, performance, and user feedback are monitored to deliver updates and enhancements.

What is the Cost of Developing Finance Apps?

The cost of developing finance apps ranges from £15,000 to £50,000, depending on their complexity, platform (Android, iOS, or both), and required features. Simple finance apps with basic features cost less, while more sophisticated apps with advanced functionalities like secure transactions, real-time synchronisation, and AI features tend to be more expensive.

Ongoing costs for maintenance, updates, and security of finance apps increase the overall investment. The precise cost varies based on the development team's location, expertise, and project requirements. The cost of app development also fluctuates depending on the technologies used and the complexity of the features integrated into the app.

How to Choose a Finance App Development Company?

To choose a finance app development company, consider factors such as their experience developing secure financial apps, expertise in relevant technologies, and a proven track record of successful projects. Evaluate their approach to user experience (UX) design, ability to scale the app, and commitment to app maintenance and updates.

It's also important to ensure a finance app development company complies with security and regulatory standards where expertise in delivering high-quality finance apps focuses on security and user-friendly design.

What are the Best Personal Finance Apps?

The best personal finance apps are Mint, YNAB (You Need a Budget), Monzo, Revolut, and Fudget. Each app offers unique features to help users manage their finances effectively.

The best personal finance apps are as follows:

- YNAB (You Need a Budget): YNAB helps individuals manage their finances by creating detailed budgets and tracking savings goals. It's best for those who want to focus on budgeting to save more money. At $14.99 per month or $99 per year, it's one of the most expensive budgeting apps on the market (rivalled only by Monarch).

- Monzo: Monzo is a popular finance app for managing personal finances. It offers features such as budgeting tools, instant spending notifications, and automatic savings. According to finder.com, Monzo reported £355.6 million in revenue for the 2023 financial year.

- Revolut: Revolut is perfect for managing multiple currencies and making international transfers. It's useful for people who travel or need to handle various currencies regularly. According to finder.com, Revolut's customer base grew significantly in 2023, increasing by 45% from 26.2 million to 38 million. By July 2024, the platform had gained an additional 7 million users, reaching 45 million.

- Fudget: Fudget is a simple, no-frills app for easy budgeting. It's ideal for users who want something straightforward and don't need advanced features.

- Splitwise: For couples, Splitwise is a great option to track shared expenses and manage finances together. It simplifies splitting costs between two people.

- GoHenry: GoHenry is the best choice for kids. It offers a prepaid debit card and financial education tools, helping children learn financial responsibility with parental controls.

- QuickBooks: QuickBooks is ideal for small business owners because it is excellent for managing finances, invoicing, and tracking business expenses.

- Tally: Tally helps college students manage credit card debt and finances, making it easier to keep track of payments and avoid debt accumulation.

Never Miss an Update From Us!

Sign up now and get notified when we publish a new article!

Dhaval Sarvaiya

Co-Founder

Hey there. I am Dhaval Sarvaiya, one of the Founders of Intelivita. Intelivita is a mobile app development company that helps companies achieve the goal of Digital Transformation. I help Enterprises and Startups overcome their Digital Transformation and mobile app development challenges with the might of on-demand solutions powered by cutting-edge technology.